The global economy, Malaysia included, continues to endure the severe challenges of the COVID-19 pandemic. This black swan event has affected Malaysians of every ethnicity and social strata as well as workers in both the public and private sectors. Whole industries faced upheavals, and many of our day-to-day interactions are now conducted virtually.

Some sectors experienced growth. The Financial and Insurance, Wholesale and retail trade, repair of motor vehicles and motorcycles, Electricity, gas, steam and air conditioning supply, Human health and social work activities & Information and communication sectors grew by 11%, 7% and 6% and 4% respectively in 2020. More recently, the highest growth of filled jobs in Services was in ICT Sub Sector of 4% in Q1 2021 VS Q4 2020.

If you wonder what and how the talent market is evolving for Telco in Malaysia, we prepared a quick snapshot for you:

Key Areas of Consideration

Commoditised offerings from industry players with differentiation mainly in areas such as pricing and customer service.

The market has reached near full saturation in terms of individual users rendering business growth ever more challenging.

Increased requirements of capital expenditure for 5G infrastructure deployment along with compliance burdens.

Opportunities for introducing new services that are enabled by 5G technologies especially in the B2B sector to monetise investments.

Larger focus on users’ data management, analysis and security.

Talent shortage in areas that are crucial for future growth.

Talent Demand Update

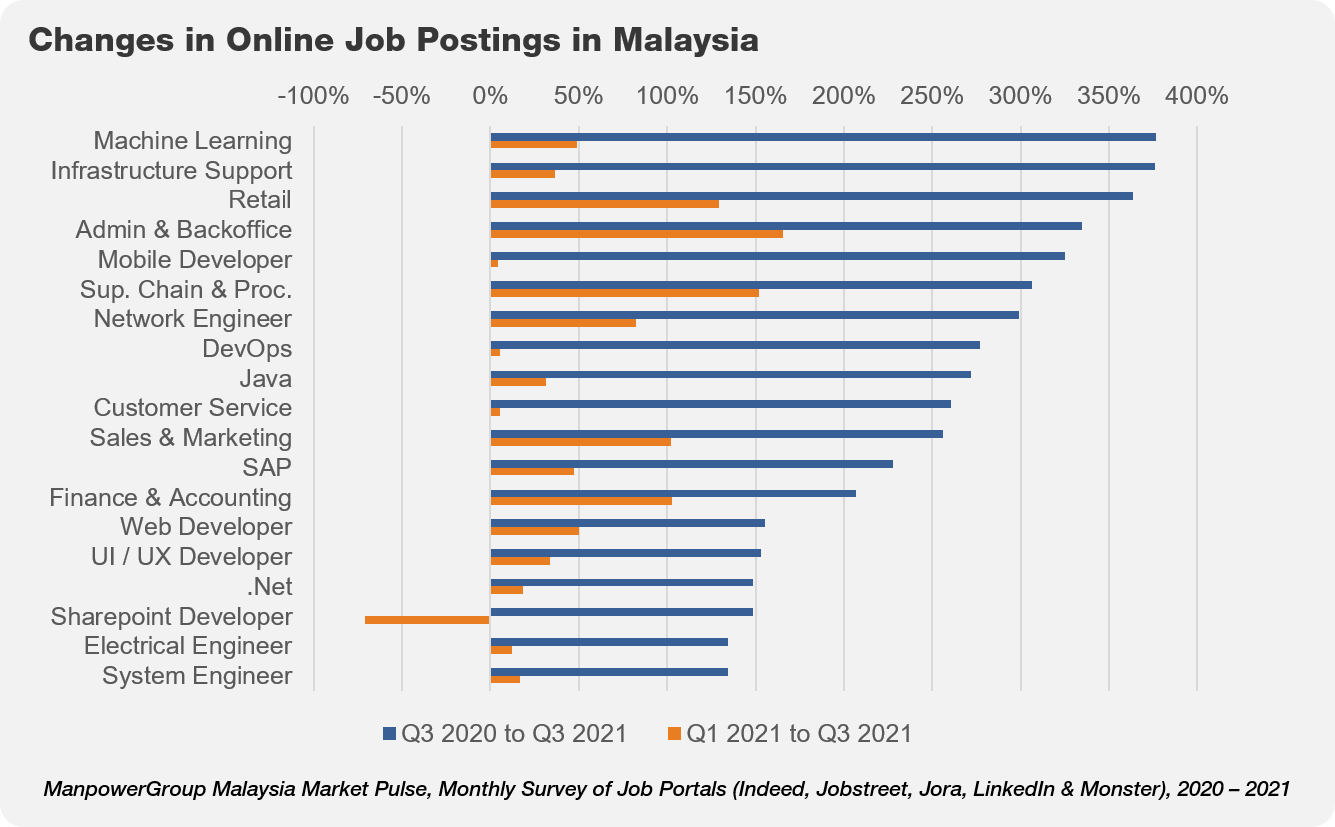

In Malaysia the Critical Occupations List highlights several positions that are needed by the Telco industry. They were mainly in IT & Networks, Data Security & Analysis, Business Development & Content Creation.

We are observing solid demand growth across these positions in Malaysia. Key skills that are needed by Telco’s to introduce new services such as Network Engineers, Developers, Sales & Marketing professionals have all grown since 2020 by an average of 240% and in 2021 by an average of 30%

Telco's Dilemma

The Malaysian mobile subscriber base is saturated with 137% of population being cellular subscribers.

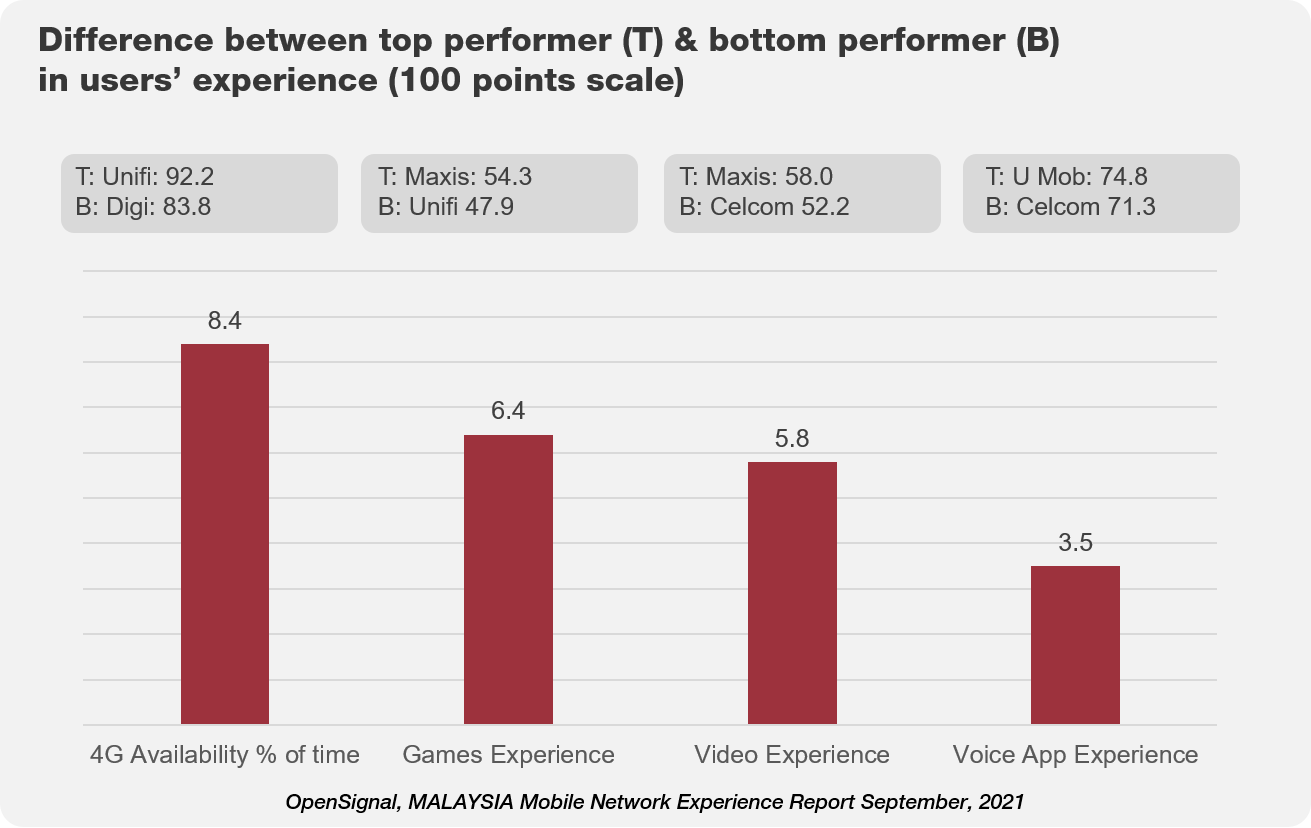

Moreover, user experience across 5 major providers is relatively same. In fact the difference in experience between top and bottom Telco companies on a 100 points scale is negligible. For example, in video experience, Maxis scored 58/100 as a top performer. Celcom scored 52.2/100 as a bottom performer.

With the increased reliance on networks as a direct result of the pandemic, Telco providers have a great opportunity to leverage new technologies and introduce 5G enabled services especially in the B2B market. For this, finding the right talent will be a key differentiator that enables business growth.

Telco Talent Preferences

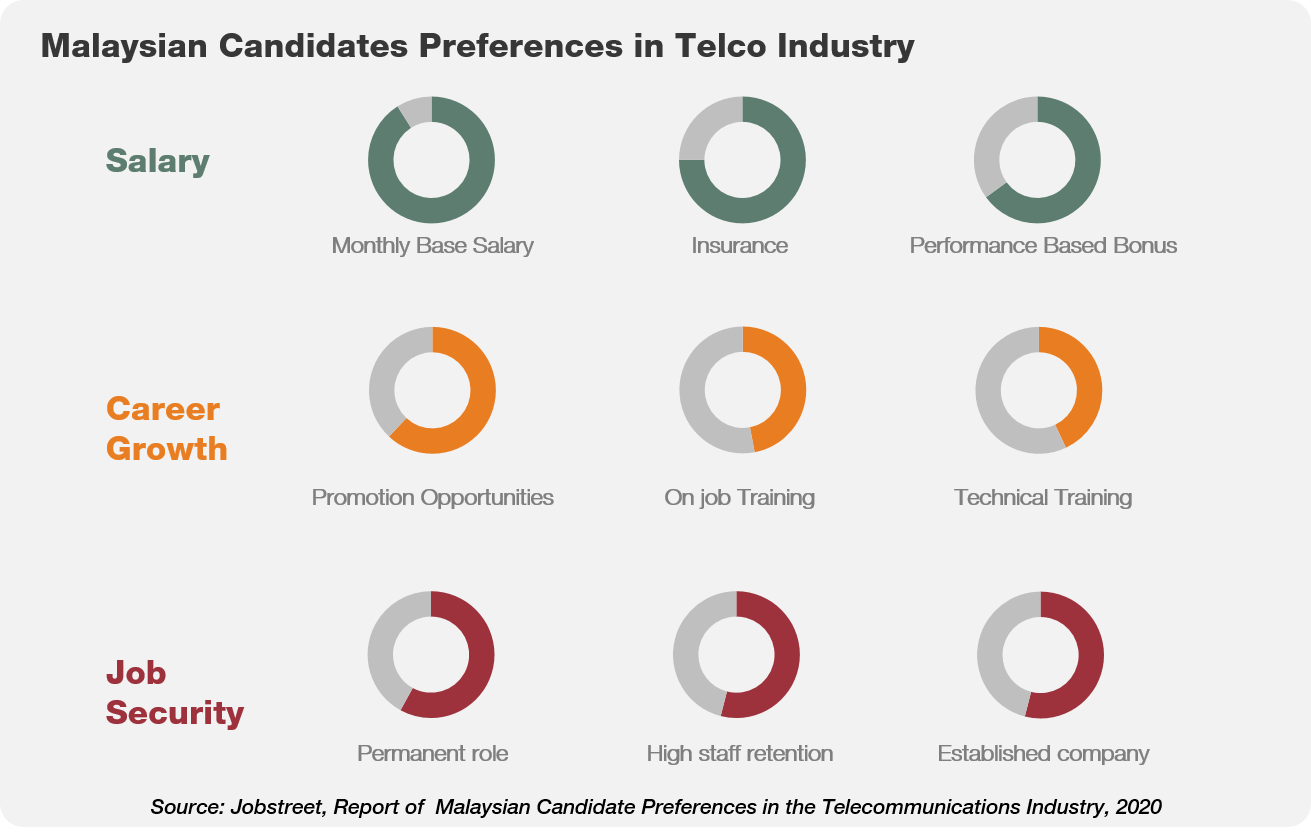

The top 3 preferences candidates in Malaysia look for when considering working in the Telco Industry are Salary, Career Development and Work-life balance.

Interestingly, unlike average Malaysian candidates, in the Telco sector Career Growth takes the second spot as the most important factor rather than Work Life Balance.

Download Whitepaper here

Get the Telco Market Snapshot to explore key questions that may help your company save costs and align with business strategies: