The Asia Pacific region is generally considered to be a low-cost option for offshoring human capital, and while that continues to be the case for the most part, consideration of regulations, skilled supply, and productivity influence which markets make sense for various employment strategies.

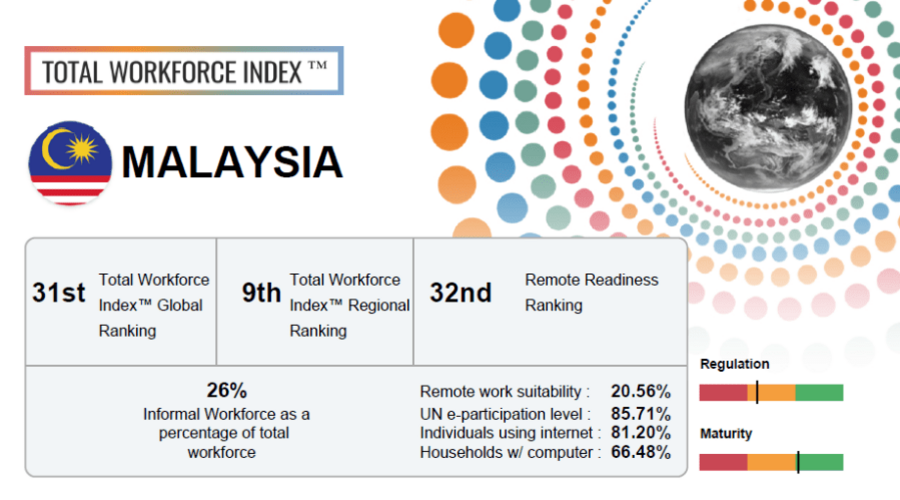

ManpowerGroup 2021 Total Workforce Index (TWI) has ranked Malaysia 31st out of 75 markets as the most favourable country for business based on skills availability, cost efficiency, regulation and productivity globally. At the same time, it ranked 32nd on the Remote Readiness Ranking and the informal workforce currently comprises 26% of the total workforce.

In the Asia Pacific, Malaysia ranked 9th out of 15 markets in the TWI.

The TWI analysed 75 markets for more than 200 unique factors, providing a comprehensive and comparative analysis of four categories: Workforce Supply, Cost Efficiency, Regulation and Productivity. The markets that rank highest in the Total Workforce Index™ are United States, Singapore and Canada with the highest relative performance across all four categories and have successfully responded to remote workforce readiness, automation, skills gaps and potential talent shortages, shifting regulations and the rapid pace of technology.

Malaysia's scoring for each indicator is as follows:

Workforce Supply

Malaysia's total workforce is 16.01 million. By generation in the total workforce, Baby Boomers (born between 1946 and 1965) make up 13%; Generation X (born between 1966 and 1975) make up 18%; Generation Y (born between 1976 and 1995) make up 35% and others make up 34%. The country comprises of 26.50% highly skilled workforce that is white collar.

While this category is not solely dependent on the size of the market's workforce, larger markets have tended to have an advantage in past years. But today's focus on virtual employees tethered to centralized projects has increased the importance of language proficiency, border access, remote scalability of resources, and workforce demographics. With this remote readiness in mind, Malaysia captures 20.56% remote work suitability with 21% of the workforce with working English proficiency.

Workforce Cost Efficiency

Cost efficiency is a factor that most organizations consider a deciding point in the market selection. This factor may remain a primary influencer driving new investments into these markets, however, ensuring that a market has an adequate supply of the right talent and legislation conducive to hiring strategies must be considered for successful hiring in foreign markets.

The reported cost of doing business in Malaysia is at 11.10% of the country's Gross National Income (GNI) per capita. Equal pay for equal work is currently not mandated, and the average monthly wage in the country is at US$779.

Workforce Regulation

Though labour regulations are rarely the primary focus of market selection, they are often a deciding factor among top contenders. The impact that the regulatory environment has on the overall investment opportunity in a particular market is critical, but too often overlooked when employers choose which markets to hire in. Evaluating markets that rank well in this category from the start can prove advantageous to organizations as they explore remote and onsite employment strategies.

As with last year, sub-contracting (contingent staffing) is allowed in Malaysia, and there is no maximum tenure for a single-term contract. In terms of openness of visa policies, Malaysia ranks 89th (Ranking of countries based on the openness of its visa policies where 1 is most open globally). At the same time, the country ranks 12th (based on economics and regulation where 1 is easiest) for ease of doing business.

Productivity

With cost often leading the way in market evaluations, wages are always top of mind. Evaluating the potential workforce productivity can ensure the accuracy and relevance of that wage analysis by accounting for the overtime, holidays, and standard working hours in a given market.

Countries with longer workdays or more hours in a workweek offer increased opportunities for higher levels of productivity without the additional cost associated with overtime premiums.

However, these markets were not ranked highest in productivity based on working hours alone. Other workforce considerations include labour market stability, infrastructural and technical readiness, and other employment restrictions that could impact an organizations workforce strategy.

The average workweek in Malaysia comprises 48 hours, versus an average of 41.7 hours in the region. However, the average workday is made up of eight hours, on par with the regional average. Further, labour market efficiency is at 70.20, slightly higher than the region's at 67.10.

Thus, with the right combination of data and insight, companies can ensure their workforce strategy is aligned to their business strategy. ManpowerGroup has spent decades developing strategies and tools that organizations can leverage today to face change. The Total Workforce Index™ is a robust tool company can leverage to make decisions for a reimagined future.

Read the summary and download the report